China Sustains Solid Q1 Growth, but Rebalancing Challenges and Deflationary Pressures Persist

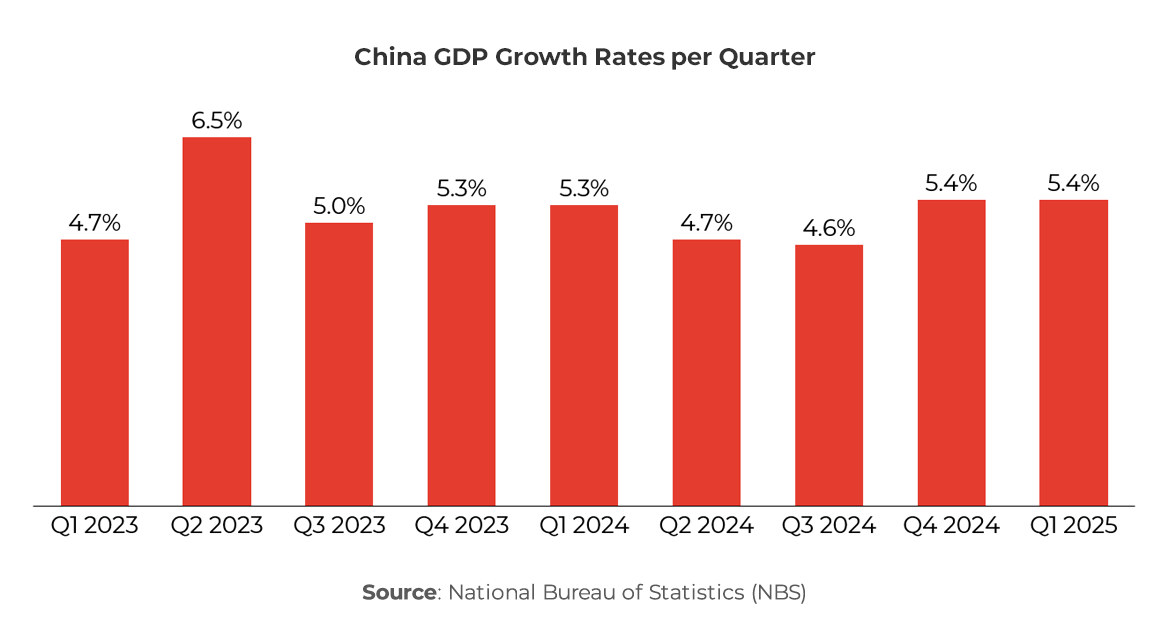

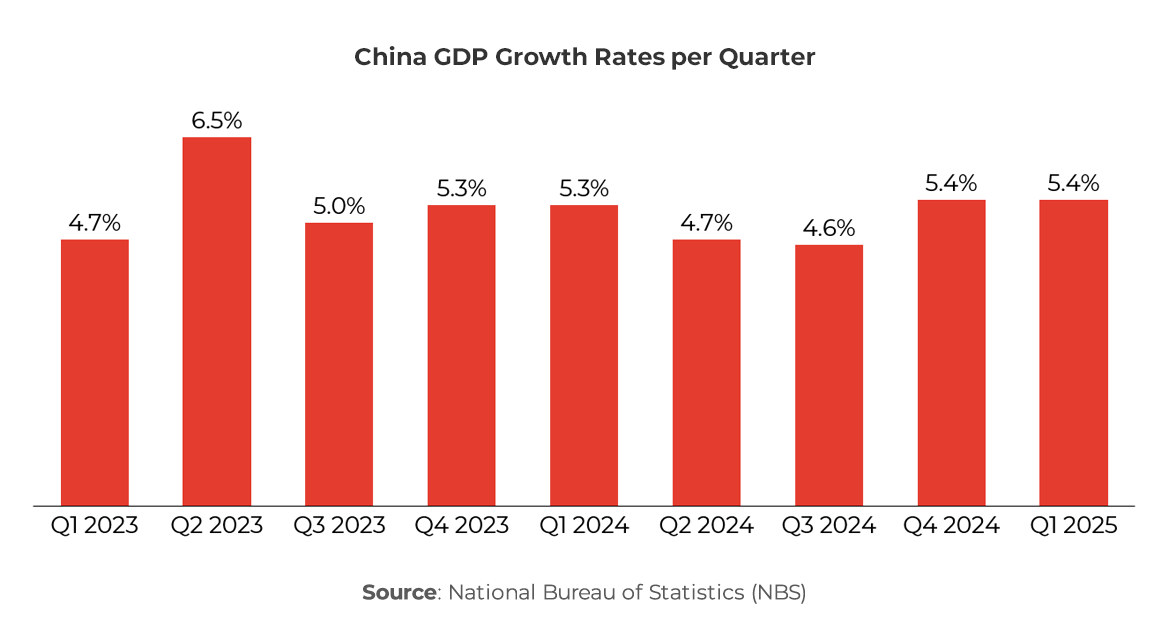

China’s economy began 2025 on a stronger footing than expected. GDP grew by 5.4% in Q1 compared to a year earlier, unchanged from the 5.4% expansion in Q4 2024 and above the 5.1% forecast from analysts’ expectations in a Reuters poll

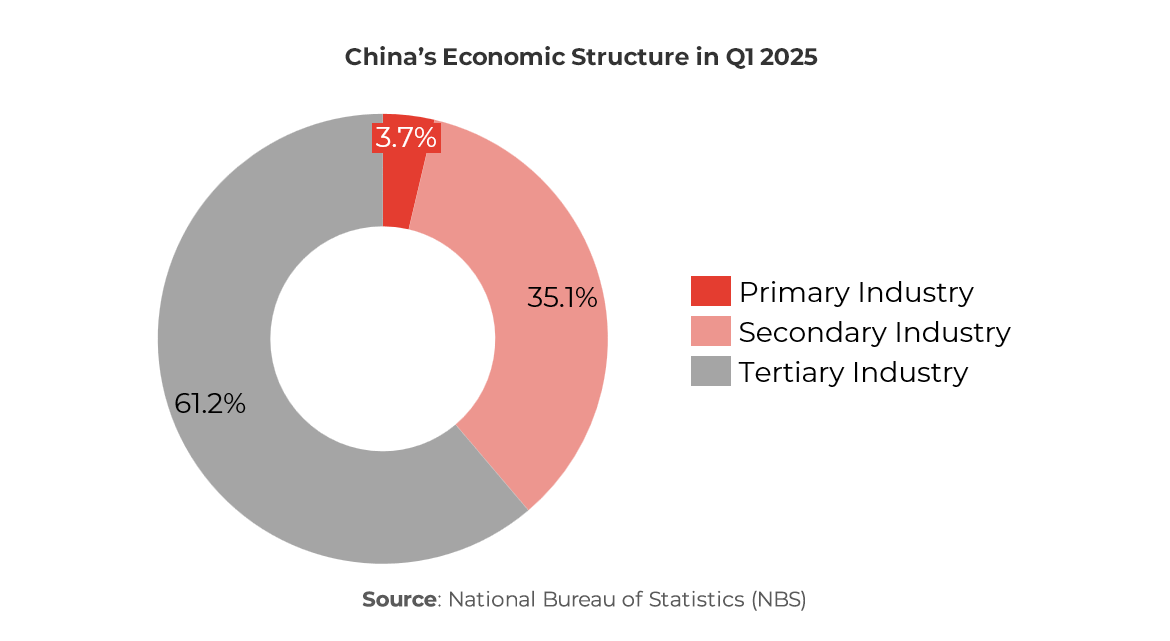

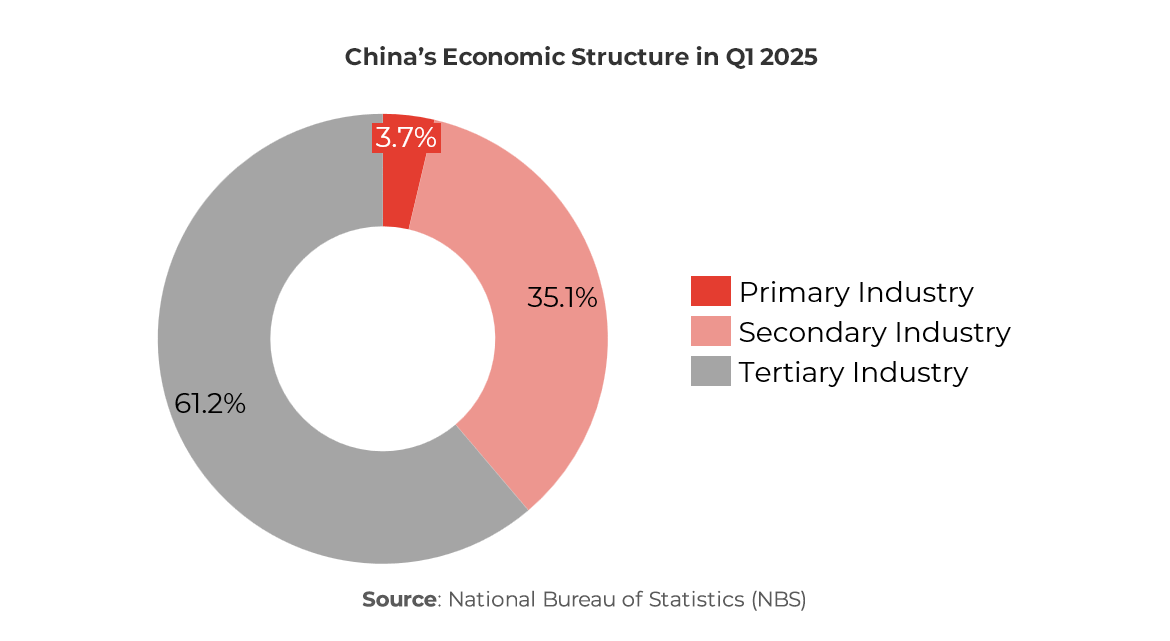

The nation’s total economic output reached ¥31.88 trillion (approximately $4.42 trillion) during the period, with tertiary industry accounting for the largest share at 61.2%.

The robust economic growth was underpinned by surprising strength in external demand and a rebound in factory output and consumption. Retail sales accelerated in March, rising 5.9% YoY (up from 4.0% in January-February), while industrial production jumped 7.7% in March (up from 5.9% in the first two months). These gains suggest stimulus measures and post-pandemic recovery in the services sector helped buoy consumer spending and manufacturing activity in early 2025. However, quarter-on-quarter growth moderated to 1.2% (from 1.6% in Q4 2024), hinting at some loss of momentum going into Q2.

Beneath the solid GDP figure, economic performance was mixed. On the positive side, the high-tech and manufacturing sectors led growth, and business confidence remained resilient. Fixed asset investment rose in infrastructure and manufacturing, supported by government incentives. Incomes also grew steadily – nationwide disposable income per capita was up 5.6% in real terms from a year ago – aiding consumer sentiment. On the other hand, the longstanding property market downturn continued to weigh heavily on the economy. Real estate investment fell by 9.9% YoY in the first three months, as cash-strapped developers cut back on new projects. New home prices were largely flat in March, signaling persistent weakness in housing demand. The property slump, which began in 2021 with major developer defaults, has not fully abated, and it has eroded local government revenues from land sales. This, in turn, has strained municipal finances and curbed public spending in some regions.

Employment and prices reflected an economy still shaking off pandemic aftereffects. The urban surveyed jobless rate averaged around 5.3% in Q1 (5.2% in March), a relatively stable level. However, youth unemployment in cities remains elevated – the jobless rate for 16-24 year-olds hit 16.9% in February, even after a statistical change to exclude students. This highlights the challenge for millions of new graduates entering a competitive job market. Meanwhile, inflation turned negative, raising deflation fears. Consumer prices fell 0.1% YoY in March – the second straight month of decline – amid sluggish domestic demand and lower food costs. Producer prices dropped even faster (PPI -2.5% in March) due to weak commodity prices and excess industrial capacity. These deflationary pressures, alongside pockets of high unemployment, underscore an uneven recovery. As Raymond Yeung, chief China economist at ANZ noted, a strong GDP print “does not represent the overall economic health” when deflation and youth joblessness remain primary concerns.

China has set a growth target of “around 5%” for 2025, and officials have pledged to support the economy with targeted fiscal and monetary measures. The Q1 results show China is broadly on track so far, but sustaining momentum will require navigating the property overhang and boosting domestic demand to offset emerging external risks.

China’s Q1 Trade Shows Resilience Through Front-Loading, but Outlook Faces Tariff and Demand Risks

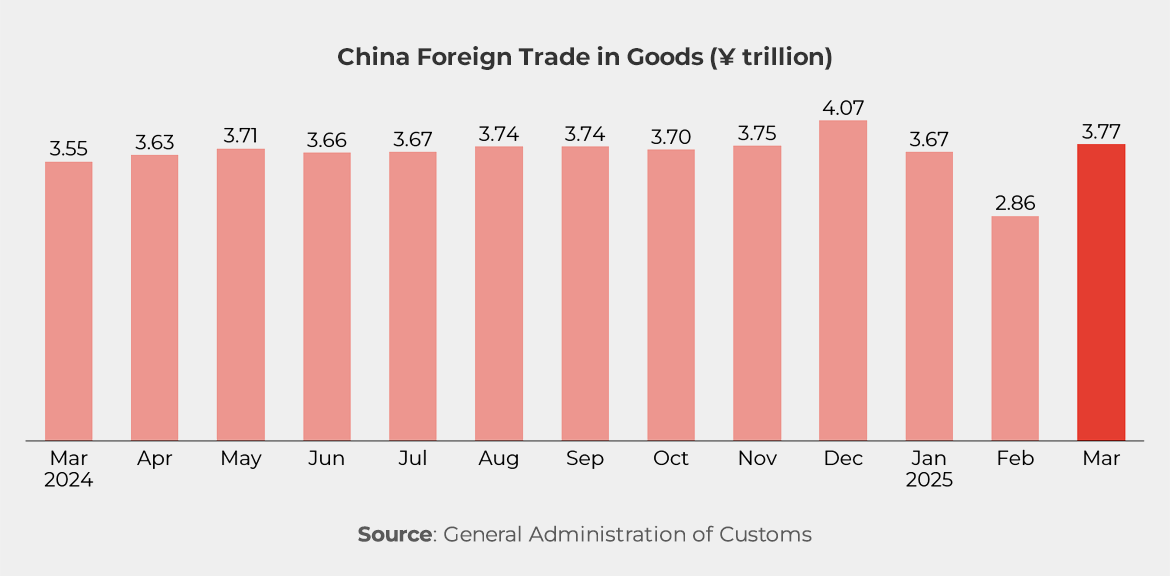

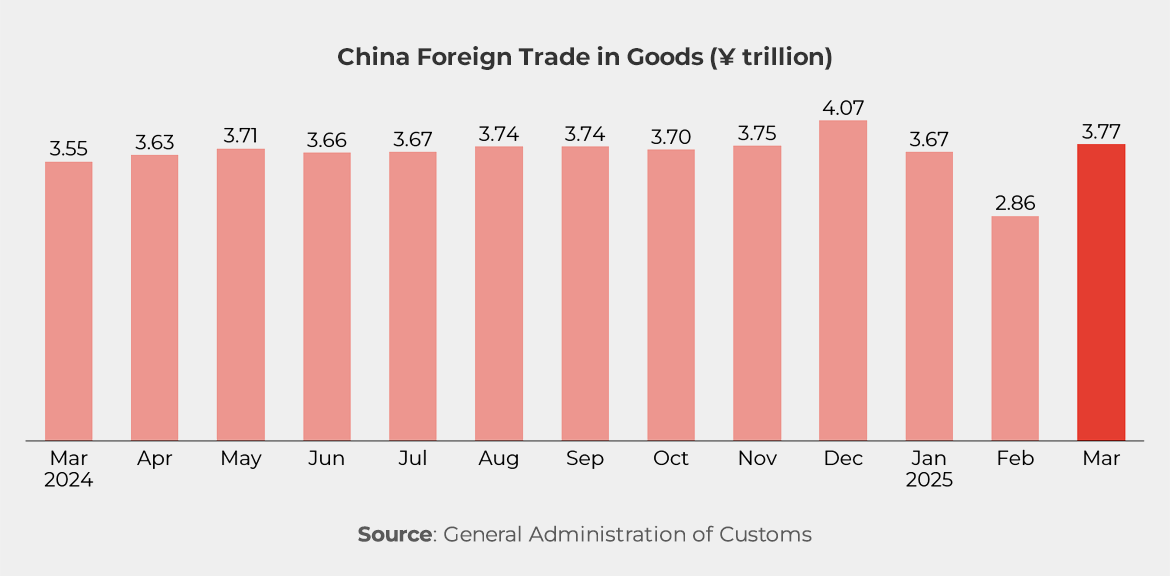

China’s foreign trade showed resilience in Q1, despite a challenging external environment.

Total goods trade (exports plus imports) reached ¥10.3 trillion ($1.41 trillion) for January-March, marking a 1.3% increase YoY and setting a record high for Q1 trade value. This was the eighth consecutive quarter with trade exceeding the ¥10 trillion mark, indicating the importance of trade as an economic driver. Notably, exports surged while imports lagged. Exports rose 6.9% from Q1 2024 to about ¥6.13 trillion ($839.2 billion), buoyed by strong overseas demand for Chinese goods. March alone saw an eye-catching double-digit jump in outbound shipments, which lifted quarterly export growth above expectations. In contrast, imports fell 6.0% YoY to ¥4.17 trillion ($570.8 billion), reflecting weaker domestic demand for foreign commodities and components. As a result, China’s trade surplus widened further, providing a net boost to GDP in the quarter.

The trade mix and partners also shifted in line with China’s evolving strategies. Exports of high-value manufactured goods remained robust – for instance, exports of electromechanical products (China’s largest export category) reached ¥5.29 trillion ($724.2 billion) in Q1, up 7.7% YoY. This suggests that China’s industrial supply chain has maintained its competitiveness even amid global uncertainties. By trading partner, China deepened commerce with emerging markets. Trade with Belt and Road Initiative (BRI) economies grew 2.2% in Q1, faster than the national average. BRI markets accounted for over 51% of China’s total trade, a record share, as Chinese companies pivot to regions in Southeast Asia, the Middle East, and Africa.

In particular, trade with ASEAN – China’s largest regional trading partner – jumped 7.1% to ¥1.71 trillion ($234.1 billion). This outperformance with ASEAN and BRI partners helped offset softer trade with developed markets. Another notable trend is the rising role of private enterprises in trade. China’s private firms contributed 56.8% of total trade value in Q1, up 2.4 percentage points from a year earlier, as their trade grew 5.8% YoY. Private manufacturers and trading companies have been agile in tapping new export markets and sourcing alternatives, helping sustain overall trade growth.

Looking ahead, China’s trade outlook is mixed. The strong export uptick in early 2025 may not be fully indicative of a lasting trend. Part of the Q1 export strength is believed to come from a “pre-tariff rush,” as exporters hurried shipments to overseas buyers before newly announced US tariff hikes took effect. This front-loading of exports boosted the Q1 figures but could lead to a payback in later months if external demand slows. Indeed, China’s customs data was released amid a new round of trade tensions, with the US raising tariffs on imports from China and other partners in early 2025. These headwinds, alongside a weaker global economy, have already led to a slight drop in China’s overall trade with the US and EU. Going into Q2, Chinese policymakers are closely watching export orders and have stepped up support for exporters – for example, expanding export credit insurance and streamlining port logistics. Thus far in 2025, China’s trade sector has provided an important cushion for growth but sustaining that performance will depend on navigating geopolitical frictions and bolstering domestic demand to reduce reliance on exports.

Property Market Slump and Local Government Debt Continue to Undermine China’s Fiscal Health

One of the most significant domestic challenges facing China’s economy in 2025 is the ongoing property market downturn and the massive local government debt linked to it.

The real estate sector – which through construction, materials and services historically contributed a large share of China’s GDP – remains in a protracted slump. Property developers have been grappling with a liquidity crisis since 2021, following the government’s credit tightening and high-profile defaults by giants like Evergrande. This crisis dramatically slowed new housing projects and decimated local government revenues from land sales (a key funding source for cities and provinces). By Q1 2025, the data still showed steep declines: real estate development investment fell about 9.9% YoY in Q1, and property sales volumes remained weak. Home prices in many cities have stagnated – March prices were flat month-on-month on average – suggesting that buyer confidence has yet to recover despite lower mortgage rates and looser home-purchase restrictions in some areas. The property slump’s ripple effects are evident in related industries (steel, cement, furniture) that have seen slow growth, as well as in reduced fiscal spending by local authorities that once relied on land auction income.

The “hidden” debt problem tied to local governments has moved to the forefront as an economic risk. Over years of rapid urban expansion, local governments often borrowed heavily off-budget through Local Government Financing Vehicles (LGFVs) to fund infrastructure and development projects. This accumulated a mountain of debt not recorded in official budgets – estimated at ¥60 trillion ($8.2 trillion) by end-2023 (nearly 48% of GDP) according to the IMF. China’s Ministry of Finance acknowledges a portion of this liability as “implicit” or hidden debt of LGFVs – about ¥14.3 trillion as of 2023 – and worries about the burden of servicing it amid shrinking revenues. The property downturn has greatly exacerbated this issue: with land sale proceeds drying up, many localities struggled to repay LGFV loans, leading to payment delays, wage cuts for civil servants, and strained public services.

In some cases, local governments amassed arrears to suppliers and construction firms, choking money flows to the real economy and even contributing to deflationary pressure in those regions. This precarious situation has raised concerns of potential defaults or a broader financial fallout if not managed carefully.

In response, Beijing has launched a major initiative to tackle hidden debt overhang while trying not to overstimulate the property sector. In late 2024, Chinese authorities unveiled a ¥10 trillion (approximately $1.4 trillion) debt-swap package to alleviate local financing risks. Under this program, local governments are being allowed to issue new bonds over several years – ¥6 trillion in new special bonds and another ¥4 trillion through 2028 – specifically to swap or refinance the legacy debts of LGFVs. The aim is to restructure expensive, opaque local debts into formal government bonds with lower interest rates and longer maturities, thereby smoothing out the repayment crunch. Officials plan to cut the recognized implicit local debt from ¥14.3 trillion in 2023 to just ¥2.3 trillion by 2028 through these swaps.

Importantly, this approach is meant to stabilize finances without direct stimulus to the property market. As mentioned by Huang Xuefeng, research director at Shanghai Anfang Private Fund Co, in Shanghai, replacing old debt with new bonds “doesn’t create new work flows”, so the immediate boost to growth is limited. In fact, the central government appears wary of reigniting a property boom or encouraging more reckless borrowing. The debt relief is conditional on local governments tightening fiscal discipline and prioritizing public welfare projects.

So far, the measures have provided some breathing room. Provinces like Guizhou, which were at risk of default, have welcomed the swaps to reduce interest costs. The national government also eased rules to allow municipalities to use fiscal funds and even asset sales to retire from debt. However, challenges remain: the scale of the problem (with total local debts likely far above the official hidden debt figures) means that some pain is unavoidable. Many local governments will face years of belt-tightening as they service restructured loans.

This could be a drag on investment in public infrastructure and social programs unless offset by central transfers. Moreover, the property sector is undergoing a structural shift. Beijing is urging localities to develop alternative revenue streams and reduce reliance on land sales – for example, by growing their manufacturing and tech industries, or implementing property tax pilots to create a more stable fiscal base.

In the long run, China’s economic resilience will depend on defusing the local debt time bomb while guiding the property sector toward a softer landing. The Q1 2025 data show that the adjustment is ongoing: the property market has yet to rebound, but aggressive policy steps are being taken to contain the fallout. How effectively China manages this balancing act – maintaining growth and financial stability as property and debt issues unwind – will be crucial for its medium-term outlook.

Escalating US-China Trade Tension Reignites External Pressures on China’s Export-Led Growth Model

In early 2025, US-China trade tensions intensified significantly, marking the return of large-scale tariff measures reminiscent of earlier trade conflicts. Under the Trump administration, the US imposed steep tariffs – some ranging from 60% to 145% – on a broad spectrum of Chinese goods, citing trade imbalances and technology concerns. China responded swiftly with retaliatory tariffs of up to 125% on selected U.S. imports. By the end of Q1, most bilateral trade was affected by punitive measures.

This escalation represents a major external shock to China’s economy. Exports – previously a critical growth driver – now face substantial headwinds. While the immediate impact included a surge in shipments due to front-loading before tariffs took effect, analysts expect this boost to be short-lived. Manufacturers report declining US order volumes and increasing margin pressures. Many firms have adopted an “anything but China” sourcing strategy to mitigate tariff exposure.

Reflecting these concerns, economists have sharply downgraded China’s growth forecasts for the full year. Whereas Beijing has an official GDP growth target of around 5%, some private forecasts now foresee growth closer to 4.0% or even lower if the worst-case tariff scenario persists. For instance, UBS warned 2025 growth could dip to 3.4% under protracted tariff strain. Such an outcome would mark a significant slowdown from the 5% pace in 2024 and would reverberate through global markets. Aside from quantitative impacts, the standoff is eroding trust between the world’s two largest economies, complicating business decisions and investment plans.

In response, Chinese policymakers have implemented both defensive and adaptive strategies. Export tax rebates and export credit insurance have been expanded to assist affected firms. Simultaneously, China is intensifying efforts to diversify trade ties beyond traditional Western partners, particularly through Belt and Road markets, which now account for over half of its trade. Domestic policy has also been mobilized, with initiatives such as consumer “trade-in” subsidies aimed at stimulating internal demand and offsetting external weaknesses.

Thus far, China has managed to keep growth on track by tapping domestic demand and alternate trade partners, even as traditional export markets soften. However, if US tariffs persist or broaden, the strain on export industries will increase, likely leading to factory layoffs and supply chain shifts that could dent China’s manufacturing base. A prolonged conflict could also impede China’s access to critical foreign technologies, reinforcing its determination to achieve self-reliance in areas like semiconductors and AI.

In the near term, Beijing’s strategy is to weather the storm by supporting affected businesses, stimulating the home market, and engaging diplomatically to manage the conflict. Q1 2025 showed that China can still deliver solid growth amid sparring with its biggest trading partner, but the real challenge will be maintaining that performance if global trade fractures further.

About this report

This report was compiled with contributions from the team of business experts across Alarar Capital Group’s global offices.

Alarar Capital Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly: