China’s economy grew 5.0% in 2024, meeting the official target

While downward pressures persist, China’s economy retains momentum, achieving 5.0% GDP growth, warranting a cautiously optimistic outlook for 2025.

In 2024, China’s economy demonstrated resilience despite domestic and external pressures, achieving a 5.0% GDP growth for the full year, with the total economic output reaching US$18.9 trillion. The fourth quarter saw a stronger rebound, growing at 5.4% YoY (year-on-year), driven by policy stimulus and improved market confidence. Key drivers included infrastructure investment, which rose by 4.4%, and manufacturing investment, which grew by 9.2%, supported by government-led initiatives such as equipment upgrades and green energy projects. However, challenges persisted: the urban surveyed unemployment rate averaged 5.1%, with structural pressures in youth employment, while per capita disposable income growth slowed to 5.1%, reflecting subdued consumer sentiment. Notably, the central government’s targeted policies, including tax incentives and subsidies for tech-driven industries, helped stabilize the labor market and mitigate risks.

China’s economic structure continued to optimize, with the tertiary sector (services) consolidating its dominance(constituting 56.7% of GDP and increasing 5.0% YoY), while secondary industries (manufacturing and construction) remained a key growth driver, growing 5.3% YoY. The primary sector (agriculture) maintained stable contributions despite slower growth(3.5% YoY). China’s industrial sector remained a cornerstone of growth, with value-added industrial output expanding by 5.8% in 2024. Advanced manufacturing and strategic emerging industries showcased remarkable dynamism. New energy vehicles (NEVs) production surpassed 13 million units, cementing China’s global leadership in this sector. High-tech manufacturing grew by 8.9%, led by sectors like aerospace equipment (+18.3%) and smart devices, including intelligent vehicle components (+25.1%) and drones (+53.5%).

Looking ahead, China’s economy is poised for moderate recovery in 2025, supported by policy tailwinds and emerging growth drivers. However, China’s economy faces a complex interplay of external shocks and internal structural transitions so that many risks need further and continue monitor. Property market adjustments, local debt sustainability, and geopolitical tensions remain critical challenges. Escalating U.S.-China strategic competition, regional conflicts (e.g., Russia-Ukraine, Red Sea crises), and “de-risking” strategies by Western nations threaten China’s access to critical technologies and global markets.

In Q4, facing global headwinds, China’s exports rise by 2.8% YoY, driven by high-tech products

China’s Foreign Trade in Q4 2024: Resilient Growth Amid Global Headwinds

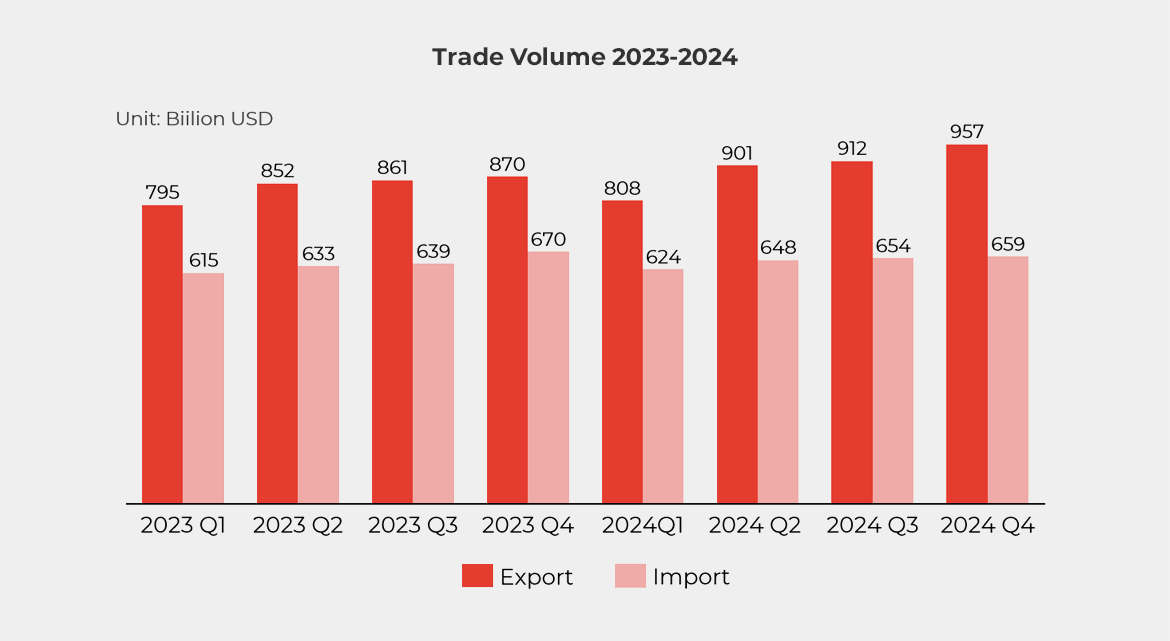

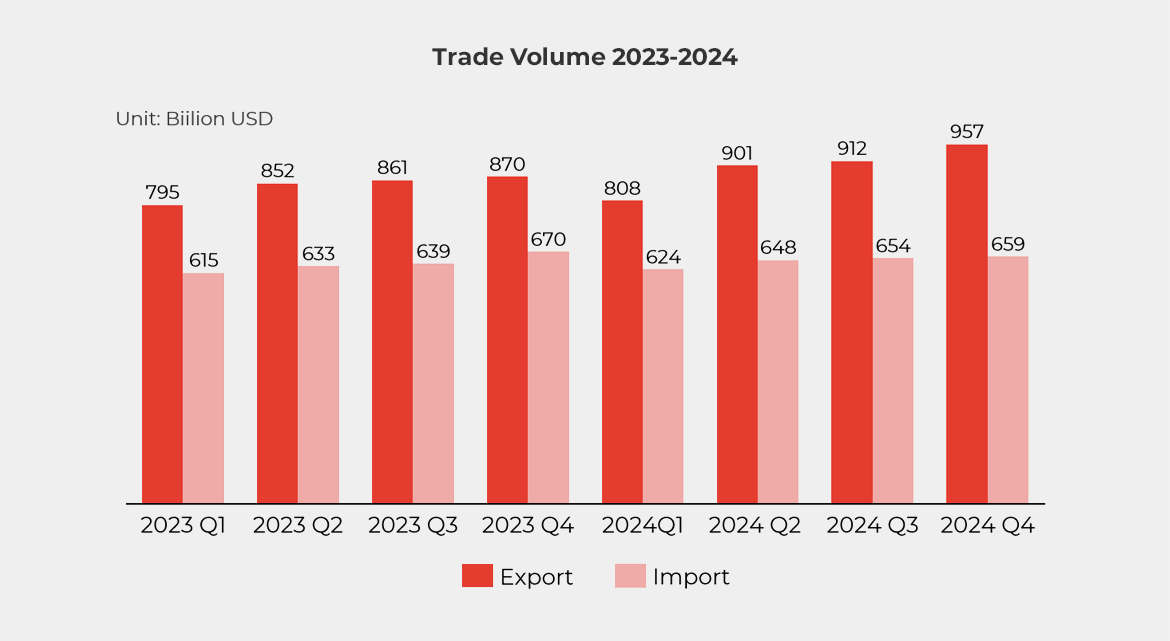

China’s foreign trade in the fourth quarter of 2024 showcased steady growth despite persistent global uncertainties. Exports expanded by 2.8% year-on-year (YoY), building on Q3’s 1.6% rise, driven by sustained demand for high-tech products, including electric vehicles (EVs), renewable energy systems, and advanced electronics. Notably, EV exports surged over 35% YoY, despite escalating trade barriers such as EU anti-subsidy tariffs, underscoring China’s competitive edge in green technologies. Meanwhile, labor-intensive sectors like textiles and furniture faced continued pressure from shifting global supply chains.

Imports grew 4.5% YoY in Q4, reflecting gradual recovery in domestic consumption and infrastructure investment. Bulk commodity imports, particularly energy and minerals, remained robust, while consumer goods imports rose 7%, signaling cautious consumer confidence. Trade with ASEAN strengthened further, with bilateral trade up 6% YoY, maintaining its position as China’s top trading partner. Exports to Belt and Road Initiative (BRI) economies climbed 12%, highlighting deepening regional integration.

However, China’s trade surplus narrowed to $185 billion, down 5% YoY, as import growth outpaced exports. While government measures, including cross-border e-commerce incentives and free trade zone upgrades, supported trade resilience, challenges such as sluggish global demand, geopolitical frictions, and supply chain realignments clouded the outlook. Moving into 2025, balancing innovation-driven exports with domestic demand stimulation remains pivotal for sustaining trade momentum.

China’s Large-Scale Equipment Renewal and Consumer Goods Trade-In Policies: A Catalyst for Economic Revitalization

In early 2024, China introduced a dual policy framework to stimulate sluggish domestic demand: the Large-Scale Equipment Renewal and Consumer Goods Trade-In Programs.

These initiatives, rooted in the government’s broader strategy to stimulate economic growth while advancing sustainability, emerged as a response to overcapacity in traditional industries and the need for green transformation. By prioritizing high-end, intelligent, and low-carbon technologies, the policies aimed to unlock a projected US$700 billion market for equipment upgrades and consumer goods replacement.

The policy framework combined fiscal incentives with structural reforms. For industries, subsidies and ultra-long-term treasury bonds—150 billion yuan in 2024, with plans for increased issuance in 2025—were deployed to modernize machinery across sectors like manufacturing, agriculture, and transportation. Businesses received interest rate subsidies of up to 1.5% to lower financing costs, while local governments tailored additional support. On the consumer side, subsidies targeted automobiles, home appliances, and, notably, digital products such as smartphones and tablets starting in 2025. For instance, buyers of new energy vehicles (NEVs) could receive up to 20,000 yuan for trading in older models, a measure expanded to include National IV emission standard gasoline cars.

By the fourth quarter of 2024, these policies had begun reshaping China’s economic landscape. Industrial equipment purchases surged by 15.7% YoY, contributing over two-thirds of total investment growth. In consumer markets, sales of home appliances and automobiles rebounded sharply, with NEV penetration reaching 47.6% annually. The trade-in programs alone generated 1.3 trillion yuan in retail sales, revitalizing sectors like electronics, where smartphone and tablet subsidies drove a 20% quarterly sales spike. Environmental benefits also materialized: carbon emissions dropped by 73 million tons, supported by recycling systems that processed 846,000 scrapped vehicles and 630,000 tons of e-waste.

The 2025 expansion will broaden subsidies to include agricultural machinery, safety equipment, and smart home devices, while streamlining approval processes to reduce bureaucratic delays. These measures will further integrate automation and green technologies into industries, fostering job creation in manufacturing and logistics. Consumer behavior is expected to shift toward energy-efficient products, aided by digital platforms offering instant rebates and expanded eligibility for items like solar panels and kitchen appliances.

However, challenges threaten to undermine these gains. Small businesses, particularly retailers, face liquidity strains due to upfront subsidy payments, with some reporting advance costs exceeding 5 million yuan per store. Fraudulent practices, such as artificially inflating prices before applying discounts, have also emerged. Meanwhile, fiscal constraints at the local level further complicate implementation, as debt-burdened regions struggle to match central funding commitments. Recycling infrastructure, though improving, remains fragmented, hindering the circular economy goals central to the policies.

The success of these initiatives hinges on balancing short-term stimulus with long-term structural adjustments. While the 2024 outcomes demonstrate their potential to drive growth and sustainability, addressing financial bottlenecks and enhancing transparency will be critical as the programs scale.

China’s Real Estate Market Update: 2024 Performance and Fourth Quarter Dynamics

In 2024, China’s real estate market navigated a critical transition marked by policy-driven stabilization efforts and gradual signs of recovery, particularly in the fourth quarter. After three years of prolonged adjustment, the sector began to show tentative signs of “bottoming out,” supported by an unprecedented wave of policy easing aimed at curbing declines and restoring market confidence.

The fourth quarter of 2024 saw a notable shift in market sentiment, driven by aggressive policy interventions. Central authorities introduced a “policy combination” including the removal of purchase restrictions, price caps, and distinctions between ordinary and non-ordinary housing, alongside reductions in mortgage rates, down payment ratios, and transaction taxes. Local governments amplified these measures, with 199 regulatory adjustments issued in Q4 alone—176 of which were easing policies—such as lifting purchase limits in cities like Tianjin, Xi’an, and Hangzhou. These efforts catalyzed a rebound in transaction volumes: national new home sales in Q4 rose 0.5% year-on-year (YoY), while sales value increased 1.0%, marking the first quarterly growth since the market downturn began. In key cities, the recovery was more pronounced. For instance, 40 major cities saw new home sales rise 0.3% YoY in December, with first-tier cities like Shanghai and Shenzhen recording monthly price increases of 0.5% and 0.2%, respectively—the first positive momentum since mid-2023. Second-hand housing markets also stabilized, with 9 out of 70 major cities reporting price increases in December.

Despite these improvements, structural challenges persisted. Full-year 2024 data revealed a 10.6% decline in national real estate development investment, with residential investment dropping 10.5%. Ongoing projects and construction areas fell by 23% and 13.1%, respectively, reflecting developers’ cautious stance amid liquidity constraints. Land markets remained polarized, with premium plots in core urban areas (e.g., Beijing, Shanghai) attracting competitive bids at average premiums of 9.0%, while lower-tier cities saw tepid demand at 3.1% premiums. Notably, state-backed enterprises dominated land acquisitions, with top 10 developers allocating over 95% of investments to first- and second-tier cities.

Policy effectiveness was uneven across segments. While demand-side incentives—such as mortgage rate cuts and subsidies—boosted transactions, supply-side risks lingered. Local governments utilized special bonds to acquire idle land and repurpose unsold homes into affordable housing, with 846,000 scrapped vehicles and 630,000 tons of e-waste recycled under related programs. However, small developers faced liquidity strains, and fraudulent practices like price inflation before discounts emerged, highlighting implementation gaps.

Central authorities have released signaled in continuing “proactive fiscal policy” support, including potential interest rate cuts and expanded special bond issuance. Priorities include accelerating urban village renewal (targeting 1 million units), promoting “high-quality housing” with green and smart features, and refining market-oriented mechanisms for land and funding allocation. While core cities may stabilize further, broader market normalization hinges on balancing short-term stimulus with long-term structural reforms—a delicate equilibrium that will define China’s real estate trajectory in the post-crisis era.

About this report

This report was compiled with contributions from the team of business experts across Alarar Capital Group’s global offices.

Alarar Capital Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly: