Popular search

Recently visited pages

Indonesia Economic Update Report, Q4 2024

In this issue

Indonesia’s Economy Grew 5.02% in Q4 2024, Driven by Household Spending and Investment

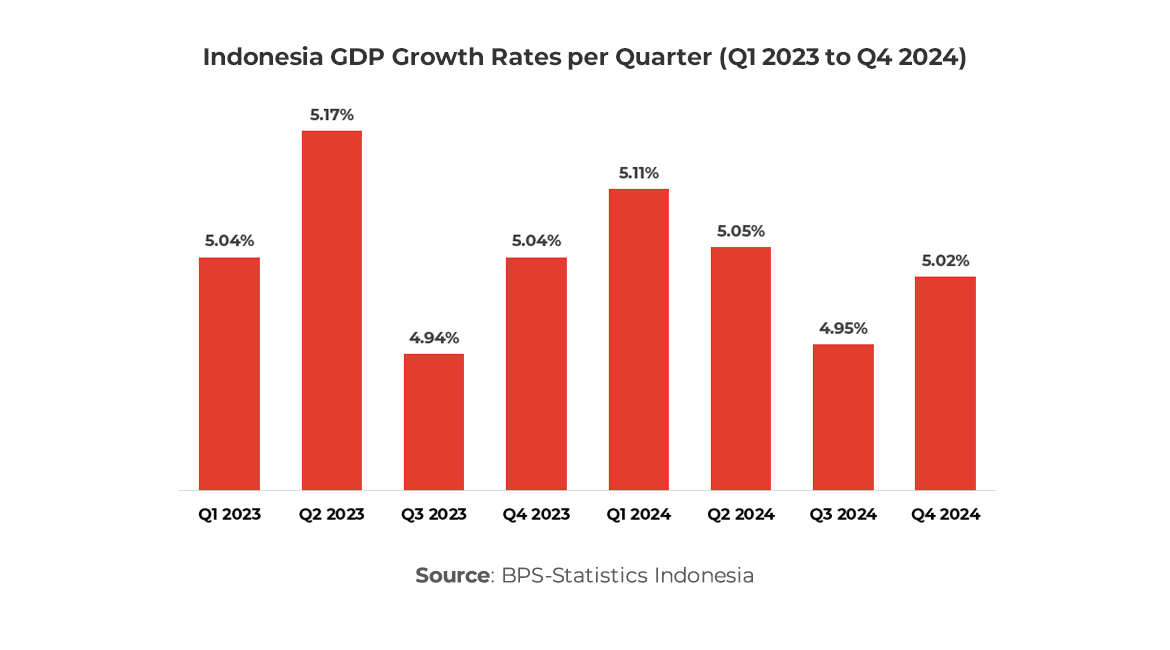

BPS-Statistics Indonesia reported that the country’s GDP expanded 5.02% year-on-year (YoY) in Q4 2024, reaching IDR 5,675.1 trillion at current prices.

This growth aligned with analysts’ expectations, with a median forecast of 4.98% from a Reuters poll, and was slightly higher than 4.95% in Q3 2024. On a quarter-on-quarter (QoQ) basis, GDP increased by 0.53%, slightly moderating from the 0.58% growth recorded in Q3. According to Bank Indonesia (BI), household consumption, investment, and government spending were the primary drivers of economic expansion. The services sector, transportation, and trade were among the strongest contributors on the supply side, while exports and public spending provided additional support.

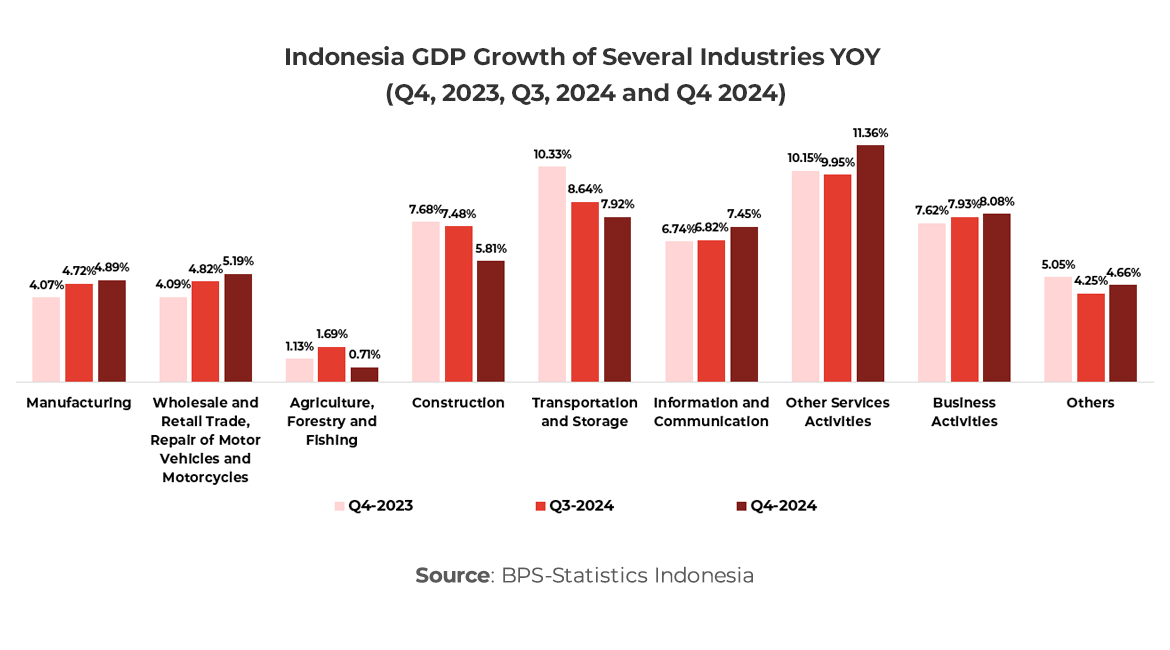

According to Bank Indonesia (BI), household consumption, investment, and government spending were the primary drivers of economic expansion. The services sector, transportation, and trade were among the strongest contributors on the supply side, while exports and public spending provided additional support. Among the fastest-growing sectors, Other Services Activities recorded the highest growth at +11.36%, followed by Business Activities (+8.08%), Transportation & Storage (+7.92%), and Information & Communication (+7.45%). Meanwhile, key economic pillars such as Manufacturing (+4.89%), Wholesale & Retail Trade (+5.19%), and Agriculture, Forestry & Fishing (+0.71%) also contributed to GDP growth.

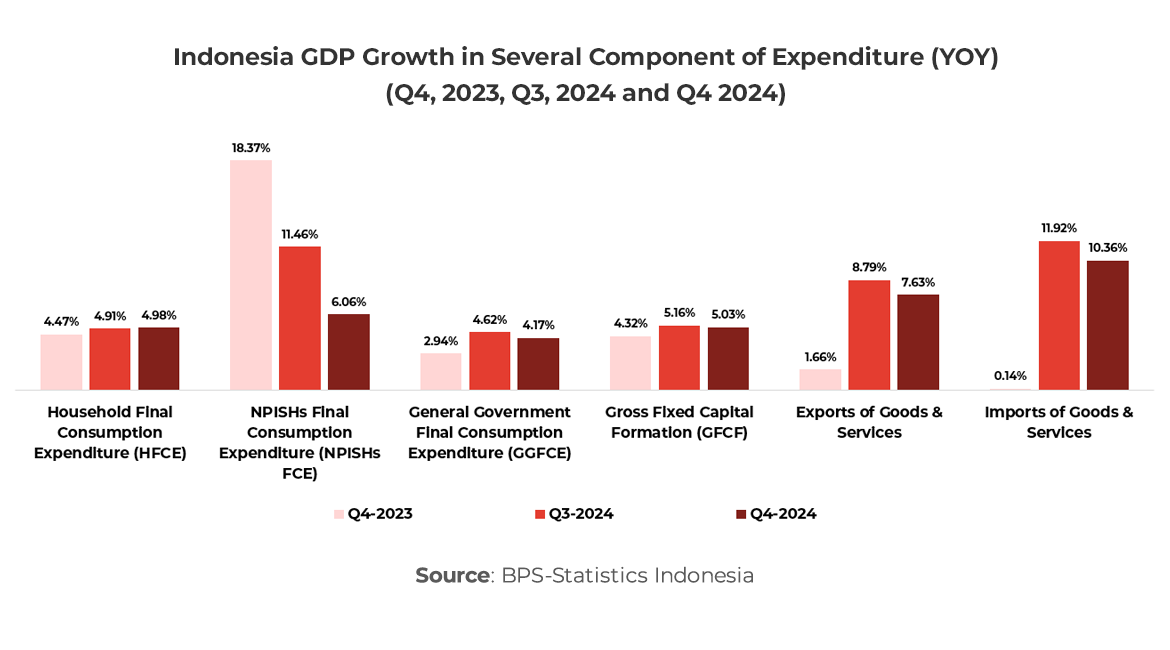

Among the fastest-growing sectors, Other Services Activities recorded the highest growth at +11.36%, followed by Business Activities (+8.08%), Transportation & Storage (+7.92%), and Information & Communication (+7.45%). Meanwhile, key economic pillars such as Manufacturing (+4.89%), Wholesale & Retail Trade (+5.19%), and Agriculture, Forestry & Fishing (+0.71%) also contributed to GDP growth. On the expenditure side, Exports of Goods and Services led with a 7.63% YoY increase, followed by Non-Profit Institutions Serving Households’ Final Consumption Expenditure (NPISHs FCE) (+6.06%), Gross Fixed Capital Formation (GFCF) (+5.03%), H Household Final Consumption Expenditure (HFCE) (+4.98%), and Government Final Consumption Expenditure (GGFCE) (+4.17%). However, Imports surged by 10.36%, which acted as a drag on net GDP growth.

On the expenditure side, Exports of Goods and Services led with a 7.63% YoY increase, followed by Non-Profit Institutions Serving Households’ Final Consumption Expenditure (NPISHs FCE) (+6.06%), Gross Fixed Capital Formation (GFCF) (+5.03%), H Household Final Consumption Expenditure (HFCE) (+4.98%), and Government Final Consumption Expenditure (GGFCE) (+4.17%). However, Imports surged by 10.36%, which acted as a drag on net GDP growth.

For full-year 2024, Indonesia’s economy expanded by 5.03%, bringing total GDP at current market prices to IDR 22,139.0 trillion. This marks a slight slowdown from 5.05% in 2023, making it the slowest annual growth in three years. However, Indonesia outpaced regional peers like Singapore (4.3%) and Malaysia (4.8%), underscoring its economic resilience amid global uncertainties. GDP per capita also rose to IDR 78.6 million (USD 4,960.3).

Macroeconomic stability remained strong, supported by low and controlled inflation. As of December 2024, inflation stood at 1.57% YoY, well within the government’s target range of 2.5% ±1%. This was a decline from 2.61% in 2023 and marked the lowest annual inflation rate in two decades. Meanwhile, Indonesia’s debt-to-GDP ratio remained at a safe 38.9% (as of September 2024), reflecting prudent fiscal management that allows for sustained public investment. In January 2025, inflation was recorded at 0.76% YoY, driven by a 50% electricity tariff discount and reduced airline ticket prices at the end of 2024.

Investment growth remained steady, with Gross Fixed Capital Formation (GFCF) expanding by 5.03% YoY in Q4, though slightly below Q3’s 5.15%. The government continued to attract foreign direct investment (FDI) and infrastructure funding, particularly in industrial parks and energy projects.

The financial sector also showed resilience. Credit to the private non-financial sector expanded by 5.2% in Q4, driven by higher demand for business loans and corporate bonds. However, household credit growth slowed to 5.9% (from 6.1% in Q3), reflecting a moderation in housing and automotive lending.

Indonesia’s Trade Performance in Q4 2024: Growth Sustains Amid Import Surge and Shifting Trade Balances

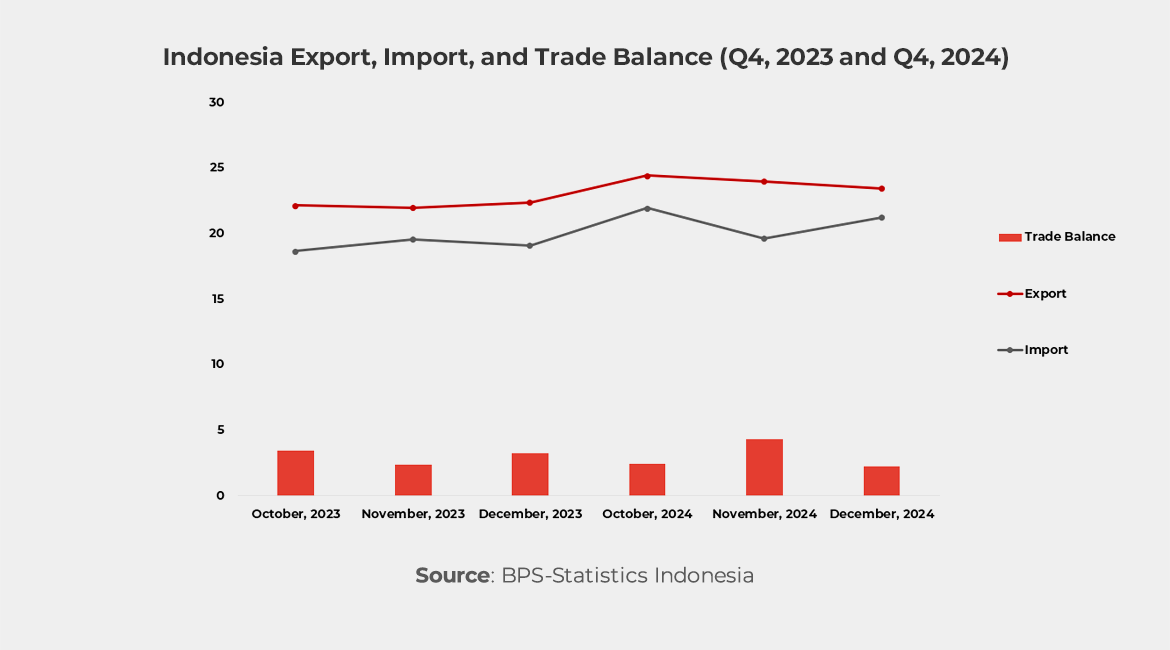

Indonesia’s trade performance in Q4 2024 remained strong, with total trade reaching $134.67 billion, reflecting an 8.69% year-on-year (YoY) increase. Exports stood at $71.88 billion (up 8.03% YoY), while imports rose 9.46% YoY to $62.79 billion. Although trade activity continued its upward trajectory, the trade surplus declined slightly by 0.88% YoY to $9.09 billion, primarily due to the faster growth in imports.

Non-oil and gas exports remained the dominant segment at $67.68 billion, while oil and gas exports contributed $4.2 billion. On the import side, non-oil and gas imports reached $53.26 billion, whereas oil and gas imports totaled $9.53 billion. The oil and gas trade deficit widened to -$5.33 billion, while the non-oil and gas trade surplus remained strong at $14.42 billion, underscoring Indonesia’s resilience in non-energy trade despite fluctuating commodity prices.

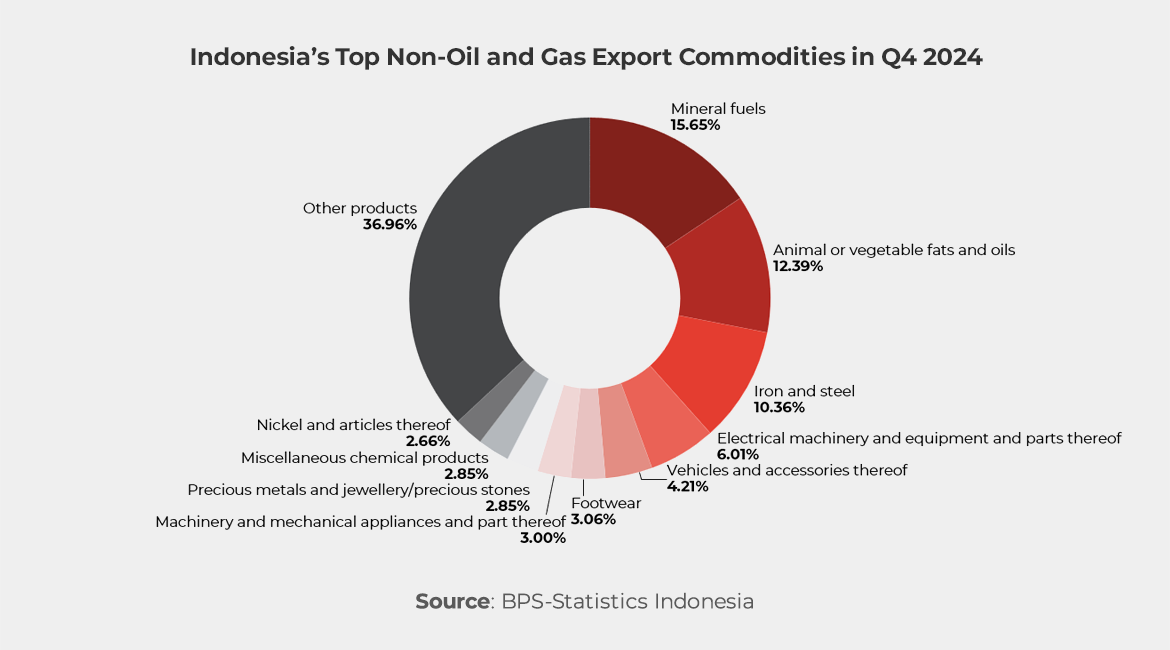

Indonesia’s export sector continued to benefit from strong global demand, with mineral fuels leading at $10.59 billion, though declining 1.91% YoY. Animal or vegetable fats and oils followed, increasing 19.24% YoY to $8.39 billion, while iron and steel remained stable at $7.01 billion, experiencing only a -0.02% YoY dip.

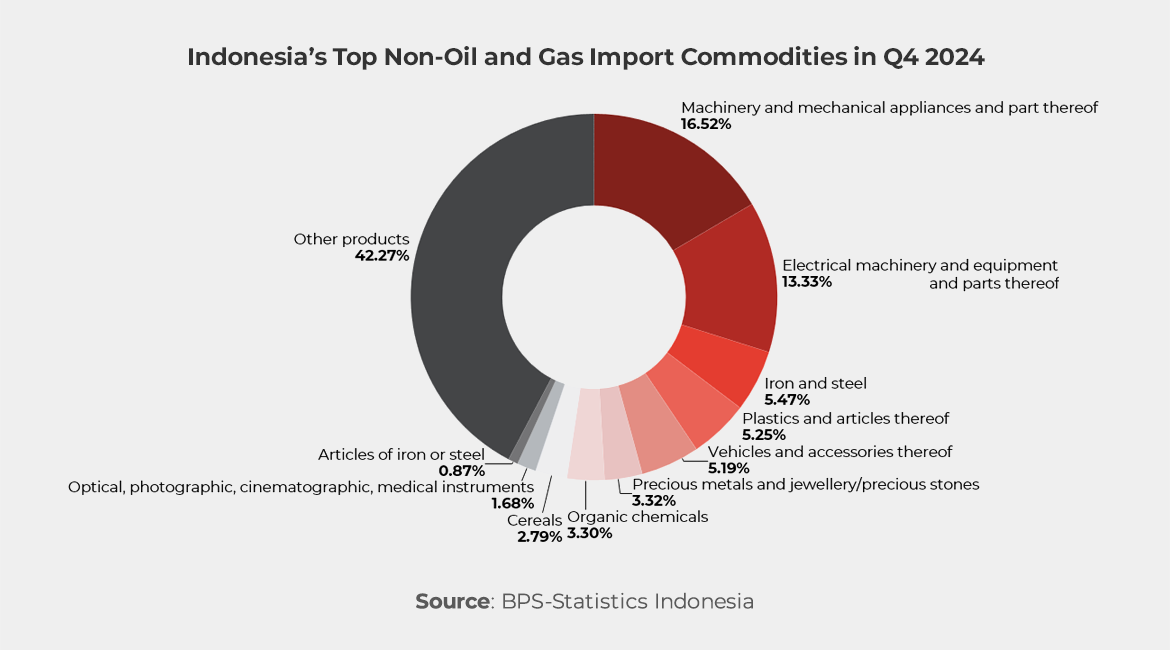

On the import side, machinery and mechanical appliances saw a 2.67% YoY rise to $8.80 billion, supporting industrial and infrastructure expansion. Electrical machinery and equipment imports surged 11.03% YoY to $7.10 billion, reflecting growing investments in electronics and manufacturing. Iron and steel imports grew 7.21% YoY to $2.91 billion, keeping pace with the increasing construction demand. The most significant increase came from precious metals and jewelry, which soared 97.50% YoY to $1.77 billion, driven by heightened gold bullion imports amid global uncertainties, while iron and steel articles climbed 50.49% YoY, reflecting shifts in supply chains and demand for specialized materials.

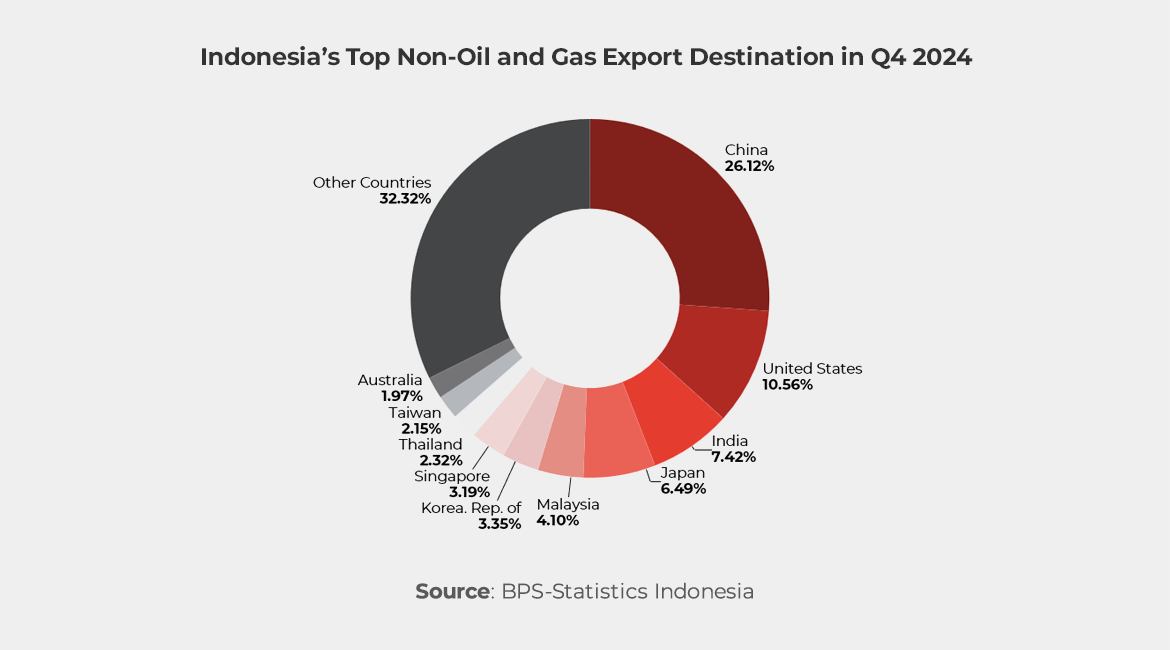

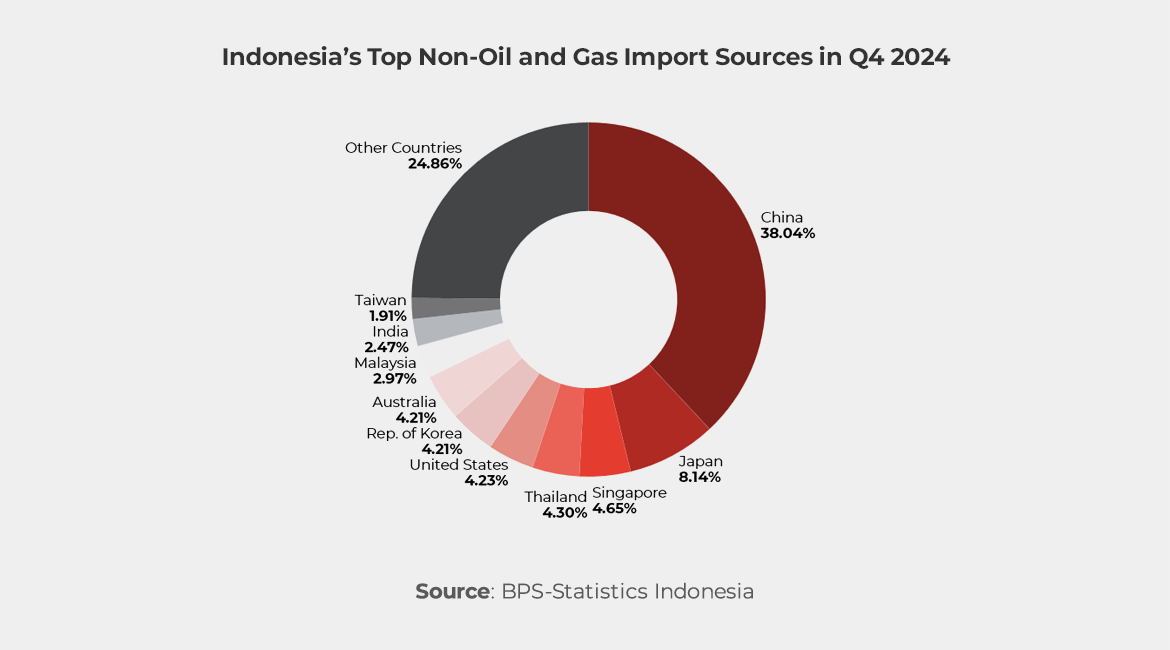

Indonesia’s trade remained heavily concentrated among its top partners, with China, ASEAN, and the United States accounting for 51.02% of total non-oil and gas trade. Detailed analysis of trade growth during 2024 with Indonesia’s main trading partners is as follows:

- China continued to be Indonesia’s largest trade partner, with total trade reaching $37.94 billion, representing a 13.39% YoY increase and accounting for 28.17% of Indonesia’s total trade value. Exports to China surged 26.12% YoY to $17.68 billion, while imports from China rose 38.04% YoY to $20.26 billion, highlighting an increasingly interdependent trade relationship.

- ASEAN followed as Indonesia’s second-largest trade bloc, with total trade reaching $21.38 billion, or 15.87% of total trade, marking a 13.44% YoY growth. Exports to ASEAN rose 18.49% YoY to $12.51 billion, while imports climbed 16.64% YoY to $8.86 billion, emphasizing deeper regional trade integration.

- The United States recorded the highest trade growth among major partners, with total trade increasing 17.85% YoY to $9.40 billion, accounting for 6.98% of Indonesia’s total trade value. Exports to the U.S. reached $7.15 billion, reflecting a 10.56% YoY increase, while imports grew 4.23% YoY to $2.25 billion.

Indonesia’s total trade for 2024 reached $498.36 billion, a 3.68% YoY increase. Exports grew 2.28% YoY to $264.70 billion, led by non-oil and gas exports at $248.83 billion, while oil and gas exports stood at $15.88 billion. Imports saw a 5.31% YoY increase to $233.66 billion, with oil and gas imports at $36.28 billion and non-oil and gas imports at $197.38 billion. The trade surplus stood at $31.04 billion, marking a 15.89% YoY decline, primarily due to the widening oil and gas trade deficit (-$20.40 billion).

Despite these challenges, Indonesia’s trade performance remains resilient, driven by strong regional partnerships and demand for non-oil and gas exports. With global economic shifts and rising industrial activity, Indonesia’s trade is expected to continue its upward trajectory into 2025, supported by manufacturing expansion, infrastructure investment, and policy measures to boost exports.

Indonesia Becomes the First Southeast Asian Nation to Join BRICS as a Full Member, Bolstering Prabowo Subianto’s Strategic Ambitions to Attract More Foreign Investment

On January 7, 2025, Indonesia made history by becoming the first Southeast Asian country to join BRICS as a full member.

The move aligns with President Prabowo Subianto’s vision of elevating Indonesia’s global economic standing, attracting foreign investment, and expanding trade partnerships. With BRICS’ growing influence in global trade and economic governance, Indonesia’s accession could have far-reaching implications for the country’s economy and its positioning in international markets.

BRICS was established in 2009 as an economic bloc of emerging markets, initially comprising Brazil, Russia, India, and China, with South Africa joining in 2010. The bloc aims to promote economic cooperation, challenge Western-dominated financial institutions, and strengthen trade relationships among developing economies. In 2024, under the BRICS Plus framework, the group expanded to include Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates.

Indonesia had previously been invited as one of 13 partner countries, alongside Malaysia, Thailand, and Vietnam, but former President Joko Widodo hesitated, citing concerns over the country’s long-standing non-alignment policy. Upon taking office in October 2024, President Prabowo prioritized full membership, seeing BRICS as a platform to enhance Indonesia’s economic opportunities and global influence.

Indonesia’s entry into BRICS is expected to unlock new economic opportunities, particularly in trade, infrastructure financing, and foreign direct investment (FDI). In 2024, Indonesia’s trade with BRICS nations reached approximately $150 billion, with key exports including palm oil, coal, natural gas, and rubber. As a member, Indonesia can strengthen trade ties with BRICS economies and diversify its export markets beyond traditional partners like the United States and the European Union.

Additionally, Indonesia will gain access to financing through the New Development Bank (NDB), a BRICS initiative focused on funding infrastructure projects in member countries. This aligns with Prabowo’s administration’s push for major infrastructure developments, which are key to achieving the government’s ambitious target of 8% GDP growth. The availability of alternative financing options reduces Indonesia’s dependence on Western financial institutions and provides greater flexibility in pursuing large-scale economic projects.

While Indonesia’s BRICS membership signals a strategic pivot towards the Global South, concerns remain about potential shifts in its foreign policy stance. Critics argue that closer ties with China and Russia, both BRICS founding members, could challenge Indonesia’s non-alignment principle. However, Indonesian Foreign Minister Sugiono has emphasized that joining BRICS aligns with Indonesia’s “independent and active foreign policy,” allowing the country to act as a bridge between developing nations and the Indo-Pacific region.

To further balance its global positioning, Indonesia is also exploring membership in the Organisation for Economic Co-operation and Development (OECD), a bloc that includes Western economies such as the United States, Canada, and the United Kingdom. By engaging with both BRICS and OECD, Indonesia aims to maintain diplomatic neutrality while maximizing economic benefits from multiple global alliances.

Indonesia’s BRICS membership could influence other ASEAN countries to follow suit. Both Malaysia and Thailand have expressed interest in joining BRICS, with Malaysia actively seeking India’s endorsement in 2024. Like Indonesia, Thailand is also pursuing OECD membership in parallel, highlighting a broader trend of Southeast Asian nations balancing their economic interests between Western powers and the Global South.

Vietnam, despite being invited as a BRICS partner country, has been more cautious, largely due to concerns over the evolving U.S. foreign policy under the incoming Trump administration. The shifting geopolitical landscape may impact how Southeast Asian nations navigate their relations with BRICS and Western economic blocs moving forward.

Launching $900 Billion Danantara Sovereign Wealth Fund, Indonesia Will Take Full Control of Its Resources with Strategic Foresight

With over $900 billion in assets under management, Indonesia’s newly launched Danantara Sovereign Wealth Fund aims to consolidate state-owned enterprises, attract global investment, and support President Prabowo’s ambitious 8% GDP growth target.

Indonesia has taken a bold step in its economic strategy with the launch of the Danantara Sovereign Wealth Fund. Officially inaugurated on February 24, 2025, Danantara aims to consolidate state-owned enterprises (SOEs), optimize investments, and accelerate economic growth. With over $900 billion in assets under management, the fund is positioned among the world’s largest sovereign wealth funds, aligning with President Prabowo Subianto’s goal of achieving 8% GDP growth by 2029. However, challenges such as fiscal constraints and structural inefficiencies remain.

Danantara, short for Daya Anagata Nusantara (“Future Power of the Archipelago”), has direct authority over SOEs, including capital allocation, restructuring, and mergers. Unlike its predecessor, the Indonesia Investment Authority (INA), which focuses on asset management and co-investments, Danantara aims to enhance SOE efficiency and profitability. The fund operates under three key bodies: a Supervisory Board, chaired by the Minister of SOEs; a Managing Board handling daily operations; and an Advisory Board offering strategic direction.

The fund’s initial $20 billion allocation will finance 20 high-impact projects in sectors such as downstream mineral processing, artificial intelligence, oil refineries, petrochemicals, food production, aquaculture, and renewable energy. Initially focused on domestic investments, Danantara plans to expand internationally in later phases, leveraging private equity and debt markets.

Danantara is expected to play a pivotal role in achieving Indonesia’s 8% growth target by enhancing SOE efficiency, attracting foreign investments, supporting infrastructure development, and fostering industrial growth. The fund aims to optimize state assets, reduce inefficiencies, and create high-value jobs. Through public-private partnerships and structured investment models, it seeks to attract global investors, particularly from the U.S., Middle East, and North Asia.

Despite its ambitious goals, Danantara faces hurdles. Fiscal constraints limit government spending, and the fund must carefully manage its cost of capital to maintain financial sustainability. External risks, such as global economic fluctuations and Indonesia’s reliance on commodity exports, could impact performance. Additionally, effective execution of SOE reforms and avoiding political interference will be critical to success.

Danantara represents a transformative step in Indonesia’s economic future. If managed effectively, it could be instrumental in realizing the country’s growth ambitions, attracting global capital, and solidifying Indonesia’s position as an emerging economic powerhouse. However, its long-term success will depend on sound governance, investment discipline, and the ability to navigate economic challenges.

About this report

This report was compiled with contributions from the team of business experts across Alarar Capital Group’s global offices.

Alarar Capital Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly:

Ready to talk to our experts?

References

- Perekonomian Nasional Tetap Solid Sepanjang 2024, Menko Airlangga: PDB Per Kapita Indonesia Mengalami Peningkatan

- Indonesian Economy Expands at a Rate of 5.02% (Y/Y) in Q4-2024

- The year-on-year (y-on-y) headline inflation in December 2024was 1.57 percent

- Indonesia’s Economic Growth 2024 was 5.03 Percent (C-to-C)

- Indonesia's economy expands 5% in 2024, more rate cuts seen in bumpy 2025

- Indonesia's economy expands 5% in 2024, more rate cuts seen in bumpy 2025

- Inflasi pada 2024 Terjaga dalam Target, Menko Airlangga: Dukung Akselerasi Pertumbuhan Ekonomi Nasional

- In January 2025 Indonesia Export and Import value reached US$21.45 billion and US$18.00 billion.

- Exports in December 2024 reached US$23.46 billion and imports in December 2024 reached US$21.22 billion.

- Exports in November 2024 reached US$24.01 billion.Imports in November 2024 reached US$19.59 billion.

- Exports in October 2024 reached US$24.41 billion & Imports in October 2024 reached US$21.94 billion.

- Exports in January 2024 reached US$20.52 billion & Imports in January 2024 reached US$18.51 billion

- Indonesia Economic Update Report, Q4 2023

- The Latest on Southeast Asia: Indonesia joins BRICS

- Indonesia joins Brics bloc as full member, Brazil says

- Indonesia’s move to join Brics signals Prabowo’s global ambitions – but risks loom

- Brazil announces Indonesia as full member of BRICS

- Indonesia Joins BRICS: Unlocking New Economic Opportunities

- Indonesia Officially Becomes First Southeast Asian Member of BRICS

- Prabowo’s pursuit of 8 per cent growth won’t be without problems

- Indonesia's new sovereign fund will run with commercial mindset, official says

- Indonesia launches Danantara investment fund, channels US$20 billion into 20 strategic projects

- Indonesia Officially Launches New Sovereign Wealth Fund Danantara

- Indonesia launches new sovereign wealth fund

Subscribe to New Articles and Alarar Capital Group Updates

Receive our latest market insights, news and reports, and business bulletins.