Popular search

Recently visited pages

Vietnam Economic Update Report, Q1 2025

In this issue

- Vietnam’s Q1 2025 GDP grew 6.9%, led by strong services, tourism, and a rebound in manufacturing despite weaker exports.

- Vietnam’s Q1 2025 trade hit USD 202 billion (+13.7% YoY), with a USD 3.16 billion surplus, as exports rose but new orders from China fell.

- Vietnam deepened strategic ties with Singapore, South Korea, and the Czech Republic in Q1 2025, while advancing renewable energy, AI, and semiconductor innovation.

- Despite signs of recovery, Vietnam’s Q1 2025 business landscape remained fragile, with rising closures, cautious production, and slowing external demand.

Vietnam’s Q1 2025 GDP grew 6.9%, led by strong services, tourism, and a rebound in manufacturing despite weaker exports

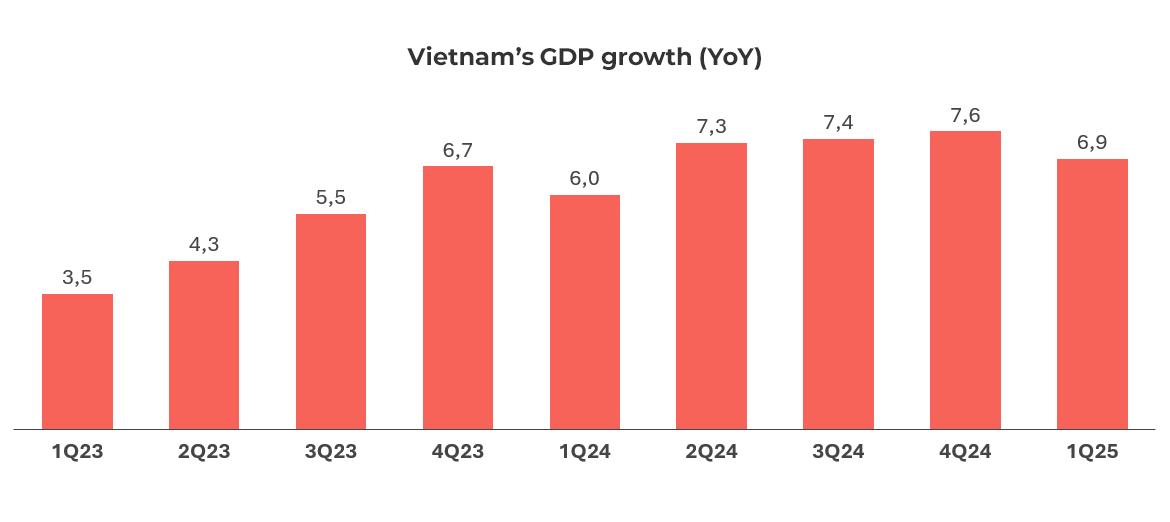

Vietnam’s GDP growth reached 6.9% in Q1 2025, slightly lower than the 7.1% achieved at the end of 2024.

The moderation is primarily attributed to a slowdown in export growth, as anticipated. However, this was partially offset by stronger-than-expected domestic consumption and a notable surge in tourist arrivals, which contributed over 1 percentage point to GDP growth.

This marked the strongest first-quarter GDP growth since 2020, indicating resilience despite external headwinds. In terms of economic structure, services accounted for 43.44%, industry and construction 36.31%, and agriculture-forestry-fishery 11.56%. Growth rates across sectors were also robust: services grew by 7.7%, industry and construction by 7.4%, and agriculture by 3.7%.

The services sector expanded by 7.7%, powered by strong consumption during the Lunar New Year. Key contributors included:

- Wholesale and retail trade (+7.47%)

- Accommodation and catering (+9.31%)

- Warehousing and transportation (+9.90%)

- Administrative and support services (+12.57%)

- Public administration and security (+9.65%)

- Education and training (+9.28%)

Total retail sales of consumer goods and services reached 1,708.3 trillion VND, up 9.9% YoY at current prices (7.5% adjusted for inflation). Passenger traffic rose significantly, with 1,414.2 million passengers transported (+17.6%) and 77.7 billion passenger.km traveled (+14.7%).

For the industrial and construction sector, in the first four months of 2025, the manufacturing sector grew by 9.5%, with processing and manufacturing alone increasing by 10%, driven by strong demand from the US, EU, and China. Key industries included electronics, textiles, and automotive.

The Index of Industrial Production (IIP) rose 8.4% YoY, with manufacturing and processing up 10.1%; electricity, gas, and steam supply up 5.1%; and waste management services up 10.2%. Mining and quarrying fell by 4.5%.

March PMI returned above 50 for the first time in four months, reflecting recovery in production and new orders. The construction sector also saw positive momentum with 7.99% growth, driven by public investment projects initiated early in the year.

Vietnam sees 40% YoY jump in FDI, highest disbursement in five years due to large scale projects

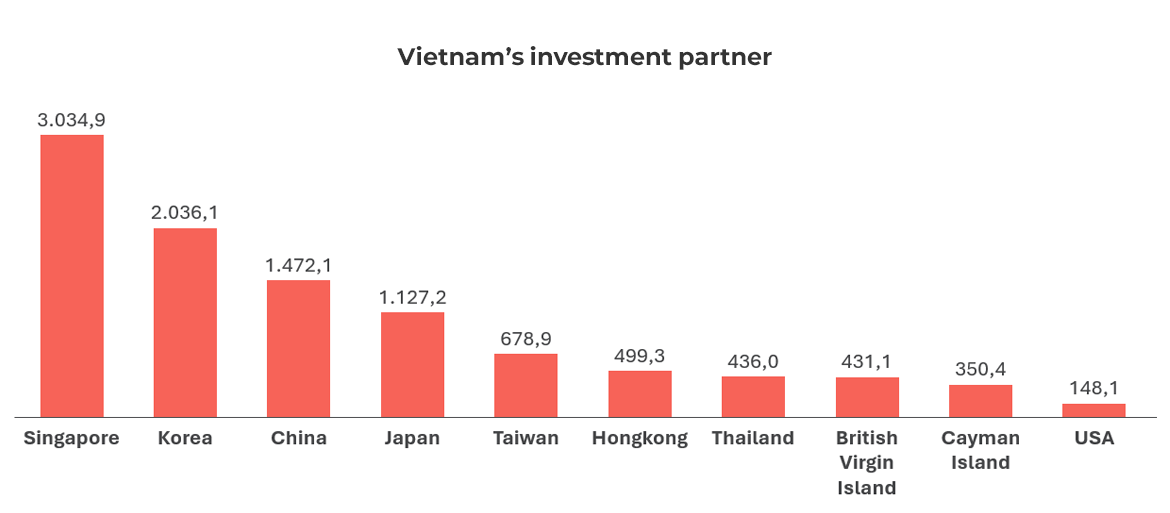

Vietnam attracted USD 13.82 billion in newly registered FDI in the first five months of 2025 (+40% YoY), and USD 6.74 billion in disbursements—the highest in five years. The manufacturing and processing sector received USD 6.8 billion.

In Q1 alone, the processing and manufacturing industry attracted USD 4.05 billion, accounting for 81.7% of total newly registered capital, followed by the real estate sector with USD 387.7 million (7.8%).

By investment partner, 73 countries and territories invested in Vietnam in the first three months of 2025. Singapore led with USD 3.03 billion (27.6%), followed by South Korea (USD 2.03 billion; 18.5%), China, Japan, Taiwan, and Hong Kong.

Major projects included significant investments from global players. Brazilian meat processing giant JBS announced a USD 100 million commitment to build two new factories, expanding its footprint in Southeast Asia. Meanwhile, UK-based energy company EnQuest acquired Harbour Energy’s Vietnam business and unveiled plans to drill new wells to enhance oil production capacity.

Additionally, 401 existing projects increased capital by USD 5.16 billion, and foreign investors contributed USD 1.49 billion in equity purchases (+83.7% YoY).

Vietnam’s Q1 2025 trade hit USD 202 billion (+13.7% YoY), with a USD 3.16 billion surplus, as exports rose but new orders from China fell, prompting modest price cuts amid stable inflation and a steady VND.

Vietnam recorded total trade turnover of over USD 202 billion in Q1 2025, representing a 13.7% YoY increase. Exports rose 10.6%, while imports increased 17%, resulting in a trade surplus of USD 3.16 billion.

Key export performers included textiles, footwear, electronics, computers and components, and machinery. In March, exports to the US surged over 30% YoY, driven by the anticipation of US tariff policy changes. However, new export orders declined significantly, especially from China, marking the fifth consecutive month of contraction in new foreign orders. Panelists noted a notable drop in demand from Mainland China.

Despite higher prices for some imported items, overall input cost inflation was mild, rising at the slowest pace in 20 months. Some suppliers reduced their prices in response to weak input demand. To maintain competitiveness, Vietnamese manufacturers reduced their selling prices for a third consecutive month, though the decline was modest.

The Vietnamese Dong (VND) remained stable through March, depreciating less than 0.5% YTD by end-March, and around 2% after the April 2nd US tariff announcement. The USD-VND exchange rate remained steady, reflecting market confidence that Vietnam would not be specifically targeted by the new US trade measures. Inflation remained contained, with CPI at 3.2% in March, further supporting currency stability.

Vietnam deepened strategic ties with Singapore, South Korea, and the Czech Republic in Q1 2025, while advancing renewable energy, AI, and semiconductor innovation—despite facing trade challenges and declining export orders.

Vietnam deepens strategic partnerships and advances innovation amid trade headwinds

In the first quarter of 2025, Vietnam made significant strides in deepening its global diplomatic and economic partnerships, while simultaneously pushing forward its domestic innovation and renewable energy agendas. These developments come at a time when the country faces rising external uncertainties, particularly linked to evolving trade dynamics with major partners such as the United States.

Expansion of strategic partnerships

On March 20, Vietnam and Singapore elevated their bilateral ties to a Comprehensive Strategic Partnership (CSP), a landmark move that makes Singapore the first ASEAN country to achieve this level of partnership with Vietnam. This upgrade reflects growing alignment between the two nations in priority areas such as the digital economy, green energy development, carbon credit trading, and supply chain resilience. A key component of this collaboration is the continued development of Vietnam-Singapore Industrial Parks (VSIPs), which serve as important platforms for industrial innovation and FDI attraction. Both sides also pledged deeper involvement in regional infrastructure projects, including the ASEAN Power Grid, a cross-border initiative aimed at enhancing energy security and regional integration.

Earlier in January, Vietnam also announced the elevation of its relationship with the to a Strategic Partnership, the first with a Central European country, marking a step toward deeper cooperation in trade, defense, investment, and education. This partnership is strategically significant, as it gives Vietnam greater access to the EU market and leverages Czech strengths in high-tech manufacturing, healthcare, and vocational training—sectors aligned with Vietnam’s development priorities. It also reflects Vietnam’s broader strategy to diversify diplomatic and economic partnerships beyond traditional allies and deepen engagement with the EU under frameworks like the EVFTA.

Strengthening economic ties

On the same day as the Singapore partnership announcement, Vietnam and South Korea reinforced their own Comprehensive Strategic Partnership. A notable outcome was the launch of a cold chain logistics center in Dong Nai Province by LOTTE Global Logistics, the first such facility located within a local industrial zone. The center is expected to significantly improve Vietnam’s agricultural and food exports by maintaining product integrity throughout the supply chain. This development supports both countries’ ambitious goal of increasing bilateral trade to USD 100 billion by 2025 and USD 150 billion by 2030.

Renewable energy acceleration

Vietnam is also intensifying its shift toward sustainable energy. On March 3, 2025, the government issued Decree No. 58/2025/ND-CP, introducing new regulatory frameworks and investment mechanisms for solar, wind, and other renewable sources. The policy aims to reduce national energy dependence on fossil fuels, align with Vietnam’s Net Zero 2050 targets, and stimulate green investment across provinces. The decree is seen as a major step toward unlocking the country’s renewable energy potential, particularly in southern and central regions.

High-tech and AI development

Central Vietnam has begun to position itself as a burgeoning innovation and technology hub. In Da Nang, the Da Nang International Data Centre JSC launched the largest data center in the region, featuring a 1,000-rack system located at the city’s Hi-tech Park. This facility will serve as a backbone for cloud services, data storage, and digital services for domestic and foreign businesses.

Additionally, FPT Group inaugurated a new AI and semiconductor-focused R&D center at Da Nang Software Park No. 2, a pioneering effort to boost Vietnam’s role in emerging technologies. As global supply chains shift and digital industries expand, these investments are expected to position Da Nang as a regional hub for innovation, talent, and advanced manufacturing.

Ongoing challenges

Despite these advancements, Vietnam continues to grapple with external challenges, particularly due to shifting U.S. trade policies that have contributed to weakening global demand. New export orders have declined for five consecutive months, reflecting a slowdown in manufacturing momentum. At the same time, business optimism among manufacturers remains below historical norms, signaling continued caution in forward investment and hiring decisions.

Expansion of Strategic Partnerships:

In Q1 2025, Vietnam made notable diplomatic progress by expanding key strategic partnerships. On March 20, Vietnam and Singapore elevated their bilateral relationship to a Comprehensive Strategic Partnership, the first ASEAN member to do so with Vietnam. This new alignment aims to enhance collaboration in the digital economy, green energy, carbon credit trading, and supply chain resilience. It also reinforces joint efforts in developing Vietnam–Singapore Industrial Parks (VSIPs) and participating in cross-border infrastructure projects such as the ASEAN Power Grid.

Earlier in the quarter, in January 2025, Vietnam and the Czech Republic upgraded their ties to a Strategic Partnership, Vietnam’s first of such status with a Central European country. This agreement sets the foundation for strengthened cooperation in trade, investment, defense, and education, paving the way for Czech enterprises to enter or expand in Vietnam’s market, especially in sectors like high-tech manufacturing, healthcare, and vocational training.

Despite signs of recovery, Vietnam’s Q1 2025 business landscape remained fragile, with rising closures, cautious production, and slowing external demand highlighting persistent vulnerabilities, especially for SMEs and exporters.

Despite signs of economic recovery across several sectors, Vietnamese businesses encountered growing challenges in the first quarter of 2025.

A concerning trend was the rising number of enterprise closures and suspensions, which outpaced new market entrants. On average, around 26,300 businesses withdrew from the market each month—approximately 2,000 more than the number of newly established firms. This imbalance signals persistent structural weaknesses in the business environment, particularly for small and medium-sized enterprises (SMEs).

At the same time, consumer confidence showed tentative signs of improvement. Retail sales, when adjusted for inflation, were initially forecasted to grow by 8% for the full year. However, this projection may face downward revision due to emerging uncertainties in global trade, which continue to weigh heavily on Vietnam’s export-driven economy. Although domestic consumption is slowly strengthening, the external environment remains fragile.

A closer look at business activity reveals early warning signs. Purchasing activity fell for the first time in four months, indicating a pause in production expansion. Many firms reported that current inventory levels were sufficient to meet short-term production needs, resulting in fewer new input orders. This inventory-driven slowdown suggests that companies are exercising caution amid an unpredictable demand outlook.

March saw a surge in production activity, likely driven by the fulfillment of earlier orders. However, this was accompanied by a sharp drop in the “Backlog of Work” sub-index, which fell from 45.1 in February to 43.4 in March. This decline represents a negative leading indicator, pointing to potential contraction in future factory output if new orders fail to pick up. It reflects reduced pressure on production lines and could signal weaker customer demand ahead.

Although short-term sentiment among Vietnamese businesses remains cautiously optimistic, underlying vulnerabilities persist. Global trade dynamics—particularly those related to slowing demand from major markets such as the U.S. and EU, as well as ongoing geopolitical tensions—pose a significant risk. Exporters and manufacturers are especially exposed, with any further disruptions likely to reverberate across supply chains and employment.

In summary, while some economic indicators in Vietnam hint at recovery, the overall business landscape in Q1 2025 presents a mixed picture. Sustained resilience will depend on how well companies can adapt to external shocks, manage inventory cycles, and capture emerging domestic demand amid global uncertainty.

About this report

This report was compiled with contributions from the team of business experts across Alarar Capital Group’s global offices.

Alarar Capital Group is an advisory firm specialised in supporting western companies operating in Asia and beyond. Our mission is to bridge the gap between global business ecosystems and key markets worldwide. Through our Management Consulting division, we provide services within corporate strategy, business transformation, operations, sustainability, growth, sales & marketing, and digital & AI solutions. We work across a wide range of industries, including automotive & mobility, energy & environment, consumer goods & retail, food & beverage, technology, media & telecom, advanced industry & materials, financial services, and healthcare, medtech & biotech.

If you are interested in exploring how we can support your business, reach out through our contact page, or leave your email below for a representative to get in touch directly:

Ready to talk to our experts?

Subscribe to New Articles and Alarar Capital Group Updates

Receive our latest market insights, news and reports, and business bulletins.